Repayment of home loan. Up to 90 of accumulated balance.

6 Reasons For Which You Can Withdraw Money From Your Epf Account

In case of mis-match in KYC details and details in EPF account please submit online request for demographic detail correction through your employer.

. From the I want to apply tab select the claim you need full EPF settlementpension withdrawalEPF part withdrawal etc. PF withdrawals within 5 years of opening an account are taxable 2. The EPF account holder hisher parents spouse or children can apply for the withdrawal.

If the mentioned bank account number in the EPF account is closed or inactive then there can be a delay when you apply for withdrawal claims. You are actually allowed to withdraw legally only if it has been more than two months that you are out of work. At the end of the employment a substantial amount is collected in the EPF account to help an individual to meet their financial needs during their retirement period.

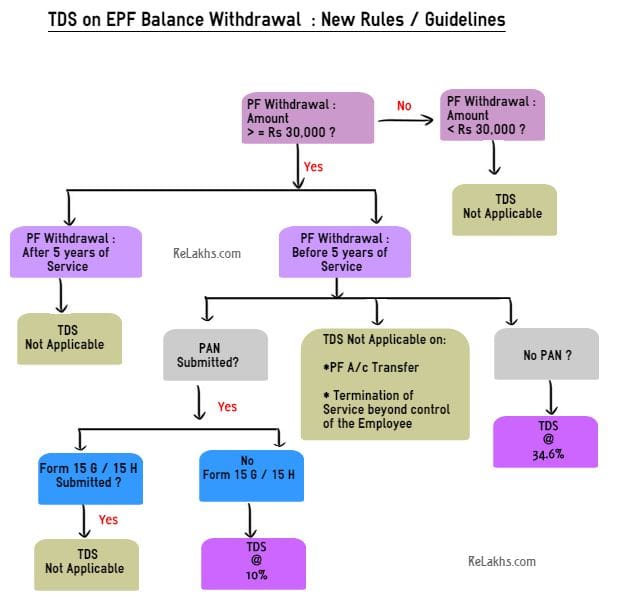

Every month a certain amount is deposited in the PF account. This interest is also subject to TDS under section 194A. 90 of the total EPF corpus can be withdrawn.

You cant withdraw PF balance from your current job. Withdrawal for purchase of house flat dwelling house additionalteration of house and repayment of loan for the purpose. Starting FY 21-22 interest on employees contribution to an EPF account above Rs 25 lakh during the financial year is taxable in the hands of the employee.

Each member or employee shall nominate a person in the declaration Epf Form-2 Withdrawal or EPF Withdrawal form conferring the right to the nominated person to receive the benefitamount in case of the death of the member or employee. A few years before retirement. The provision to withdraw money from EPF accounts was first announced in March 2020 under the Pradhan Mantri Garib Kalyan Yojana PMGKY According to the withdrawal rules EPFO members can take non-refundable withdrawals of up to three months basic earnings and dearness allowance or 75 percent of the EPF account balance whichever is smaller.

Individuals can apply for premature withdrawal from their EPF account under the. News Update 1 st June 2021. Only the EPF account holder andor hisher spouse can apply for EPF withdrawal in this case.

Construction of house or land purchase 4. NPS Tier 2 Account. EPFO allows members to withdraw money from EPF Account twice to meet COVID-19 Emergency.

NPS Tier 2 account does not have any lock in period. PF withdrawal conditions to keep in mind. Withdrawal from Account 2 to reduceredeem housing loan balance.

EPF Form 31 is used to make declaration for partial. EPF allows members to make a partial or full withdrawal from their savings to pay for specific needs under medical housing loans and education. Step 10 Select PF Advance Form 31 and provide the details of the amount you need the reason to withdraw etc.

Renovation of a house. EPF Form 31 is for partial withdrawal of funds from EPF or Employees Provident Fund. The accumulated funds from the EPF account including the employee and employers share.

In case the PF contribution of the employees was deducted but the employer did not deposit it to the EPF contribution then the amount will not be allowed as a deduction for the employer. Land purchases construction or the purchase of a new house. Following is the withdrawal process for NPS Tier 2 account.

Declaration in Form 31. Therefore subscribers can withdraw their deposits any time. With Online EPF service you can check your EPF balance printing the EPF statement EPF details like when your employer bank in the EPF money into your account EPF Account 1 and Account 2 detail and so on.

PF withdrawal for a particular purpose. After the 10 years of the completion of the house. The employee has to manually fill his details in the form while applying offline whereas if the employee applies online most of hisher details will be auto-filledHowever the member has to register his UAN to avail the online service.

The labour ministry has announced that EPF members can now withdraw twice from their EPF account to meet the emergency expenses arising due to the Coronavirus pandemic. 36 months basic wage plus Dearness Allowance. The Employees Provident Fund EPF members should ensure that their bank account details are up-to-date correct and that the account is active.

Step 11 Click on the certificate to submit your application. EPF Form 31 can be filled online as well as offline. However for government employees there is a three year lock in period if they wish to avail tax benefits.

The bank account details have to be digitally approved by the employer. 85 rate of interest is applicable to the EPF contribution for FY 2020-21. List of Epf Withdrawal Form like 5 9 10-c 10-d 13 14 19 etc available at epfindia official website.

2-3 month back have transferred my old epf account to current epf account but problem is that old UAN is also live till now and old pension amount showing their now need to withdraw advance PF for house construction but portal not allowing me due to below 60 month current PF account while my old PF service was 75 yrs and new PF service is 2. Completely fill the UOS-S12 form for withdrawal. PF Withdrawal Rules 2022.

This amount keeps earning interest and forms a large corpus. Withdrawal from Account 2 to build a house. 2021 Union Budget Update.

Incorrect details can lead to failure of credit of EPF amount as well. Also EPF withdrawals are liable to income tax if withdrawn before five years of service. To purchase a house flat or to construct a residential property.

Partial withdrawal before retirement. Learn about EPF Form 31 download submission of online application through form 31 and much more. The employee should have been in continuous service for 3 years.

Repayment of home loan 6. 24 months basic wage and Dearness Allowance. TDS Tax Deducted at Source is applicable on pre-mature EPF Employees Provident Fund withdrawals of Rs 50000 or more with effective from June 1st 2015.

Nowadays Malaysias government done a good job on published the KWSP service online Online EPF Account.

Epf Withdrawals New Rules Provisions Related To Tds

Pf Withdrawal Everything You Need To Know About Epf Withdrawal

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

Pf Money Withdrawal Step By Step Guide To Do It Online Provident News India Tv

Pf Withdrawal Rule Here S How To Withdraw Money From Your Epf Account Online Utkal Today

How To Withdraw Epf For House Construction In Just 5 Minutes Youtube

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

How Can You Withdraw Your Epf Funds Online Paisabazaar Com

Epf Withdrawal For House Flat Or Construction Of Property Basunivesh

Epf Withdrawal Rules 2022 All You Need To Know

Construction Of House Epf Advance Construction Of House Epf Withdrawal Limit Pf House Construction Youtube

Pf Withdrawal Rules Epf Withdrawal Status Online Forms Process

Epf Withdrawal Made Simple No Sign Required From Employer

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

Pf Withdrawal Process Online 2021 Pf Advance Limit And How Many Times Advance Pf Can Be Withdrawn Youtube

How To Withdraw Epf And Eps Online Basunivesh

How Can You Withdraw Your Epf Funds Online Paisabazaar Com

Pf Withdrawal Everything You Need To Know About Epf Withdrawal

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

- tempat menarik di temerloh

- occupational safety and health malaysia

- iklan kereta proton saga

- senarai nama kumpulan nasyid

- ssm semak nama syarikat

- bentley music penang

- vcu health short pump va

- matcha nama chocolate recipe

- asal usul nama matang

- langkah-langkah yang perlu dilakukan untuk menjaga nama baik keluarga

- minyak hitam 100 cc

- silver fast print kalendar

- www.kwsp.gov.my i-akaun majikan

- kad nama hari guru

- fesyen rambut lelaki mengikut bentuk muka

- raisyyah rania yeap instagram

- no telefon pos laju

- nota sirah tahun 5

- kipas radiator tidak berpusing

- nak makan apa eh